| Closing Disclosure - Purchase > Purchase - Page 2 > E. Taxes and Other Government Fees |

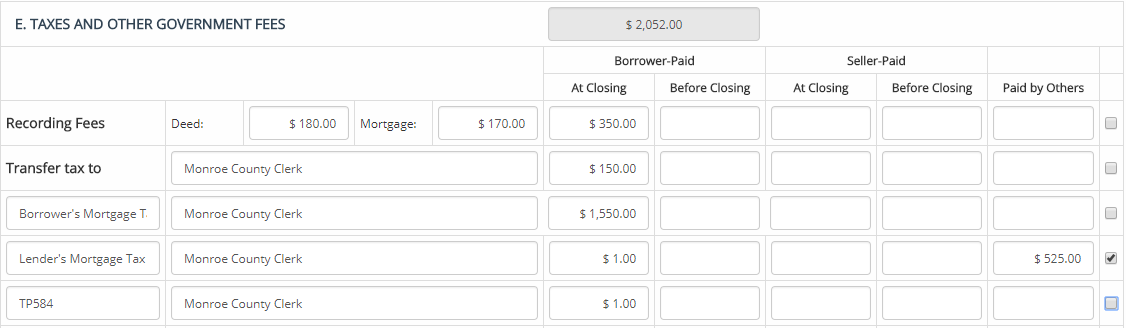

Enter the amount paid by the consumer, and/or seller, as applicable, for Recording Fees, Deed and Mortgage.

Recording Fees, Transfer Charges and Taxes on Deeds and Mortgages

The Easy HUD program’s has a built in state charge calculator module to compute charges (recording and transfer taxes) for lines 1201 to 1205. You can choose from a list of pre-entered rates for various states/jurisdictions. If for any jurisdiction, rates are different than provided, you can adjust rates for each of your HUD file. Any changes made will be saved with your HUD file. If your jurisdiction is not available in the provided list or provided rates are no longer applicable, please contact Easy Soft to obtain new rates table. This help page provides an overview and examples of various fields and calculations logic in the state charges screen.

How to use the State Charges Calculator: Set your default jurisdiction. Enter sale and loan amount in lines 101 and 202 respectively. Then, click on "Tax Table" yellow button in 1200 section. Review and make any necessary changes in the rates, allocation numbers and click "OK". Calculated values will automatically be inserted at appropriate places. If for any reason, you decide to discard changes made in the calculator and simply retain your previous values, click "Cancel".

Auto-calculate tax checkbox: Each section of the calculator has this checkbox. If for any section, you do not want the calculator to compute taxes and insert values in HUD file, "uncheck" this box. This will allow you to "disable" the auto entry of charges for that particular section.

Block 1: General Info: This section displays selected jurisdiction, sale amount and loan amounts. Values entered in lines 101 and 202 are used as basis to compute various deed and mortgage charges. After computing values once, if 101 or 202 values are changed, a warning message is displayed that 1201 to 1205 charges may need to be recomputed. Simply launch the calculator again and click "OK" to recalculate and insert charges.

Line 1201: Govt Recording Charges: This section computes 1201 Deed, Mortgage and Release charges. All of these three categories provide you with options to separate charges for 1st set of pages and 2nd set of pages and their respective rates. If for any set charge is a fixed amount (i.e. does not depend on actual number of pages), select the corresponding "Fixed" button. For release, there is an extra "Fixed" button, which will overwrite page based calculations with the fixed amount entered.

Enter the name of actual Payee and Description, as this information will be automatically transferred to HUD form and disbursement checks.

Line 1203/1204/1205 (Transfer Taxes): All of these sections follow identical structure and calculation logic. Basically, the screen is designed to accommodate a variety of tax structures currently applicable in different jurisdictions for taxation based on either sale amount or loan amounts. Below are five examples of different tax scenarios and how the values should be entered in deed and/or mortgage sections for these lines.

Case 1: $1 for each $500. Seller pays 100% of the tax.

Case 2: 1% of sale amount for first $100k and 2% for amount remaining over $100k. Seller pays 100% of the tax.

Case 3: 1% of the same amount if sale amount <= $100k. If amount is over $100k, 2% of the entire sale amount. Seller pays 50% of the tax.

Case 4: $1 for each $1000 for first $100K, and $1.5 for each $500 for amounts over $100k. Maximum applicable tax is limited to $5000. Seller pays 50% of the tax.

|

Case 5: 1% of the sale amount only if sale price is over $1M (typically called "Mansion Tax"). Buyer pays 100% of the tax. Field |

Case 1 |

Case 2 |

Case 3 |

Case 4 |

Case 5 |

||||

|

Tier-1: Unit Rate |

1 |

.0001 |

.0001 |

1 |

0 |

||||

|

Tier-1: Unit Size |

500 |

.01 |

.01 |

1000 |

1 |

||||

|

Tier-1: Limit |

(for first) 100000 |

(till) 100000 |

(for first) 100000 |

(till) 1000000 |

|||||

|

Tier-2 Unit Rate |

.0002 |

.0002 |

1.5 |

.0001 |

|||||

|

Tier-2: Unit Size |

.01 |

.01 |

500 |

.01 |

|||||

|

Max Tax |

5000 |

||||||||

|

Buyer % |

0 |

0 |

50 |

50 |

100 |

||||